Are you ready to tackle your taxes in 2026? Keeping track of important dates on the IRS tax calendar can help you stay organized and avoid missing deadlines. Whether you’re an individual taxpayer or a business owner, staying up-to-date on tax deadlines is crucial.

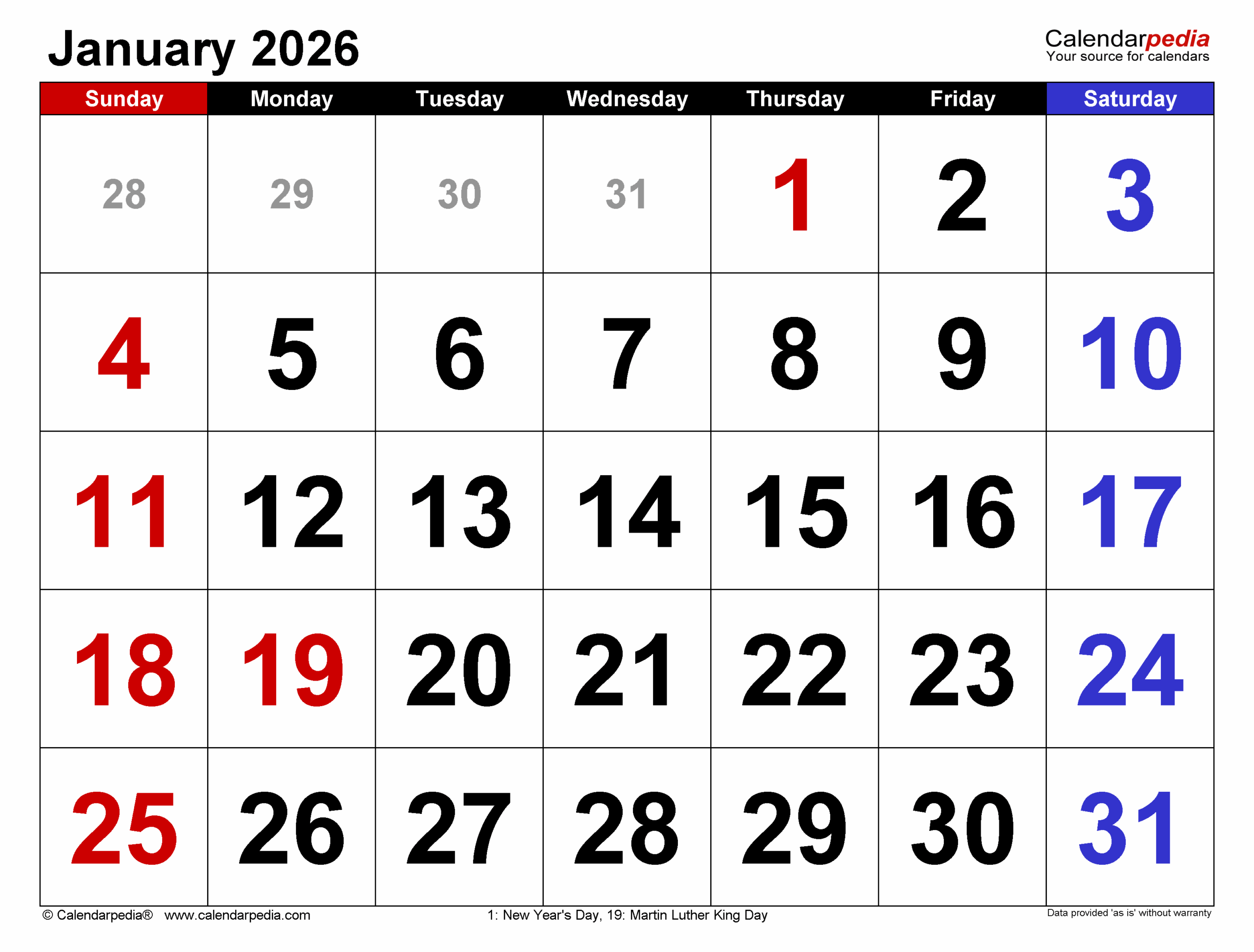

January is the beginning of a new tax year, and it’s essential to start the year off right by marking important dates on your calendar. From estimated tax payments to filing deadlines, staying on top of your tax obligations can help you avoid penalties and interest.

Irs Tax Calendar 2026 January

Irs Tax Calendar 2026 January

One key date to remember in January is the deadline for fourth-quarter estimated tax payments for the previous tax year. If you’re self-employed or have other income not subject to withholding, make sure to submit your payment by the due date to avoid penalties.

Additionally, January is a good time to start gathering your tax documents and receipts to prepare for the upcoming tax season. Organizing your paperwork early can help streamline the filing process and ensure you don’t overlook any deductions or credits you may be eligible for.

As you navigate the IRS tax calendar in January, don’t hesitate to reach out to a tax professional if you have any questions or need assistance. They can provide valuable guidance and help you maximize your tax savings while ensuring compliance with tax laws.

Stay proactive and informed when it comes to your taxes in 2026. By staying on top of important dates and deadlines, you can avoid last-minute stress and potentially save money on your tax bill. Here’s to a successful tax year ahead!

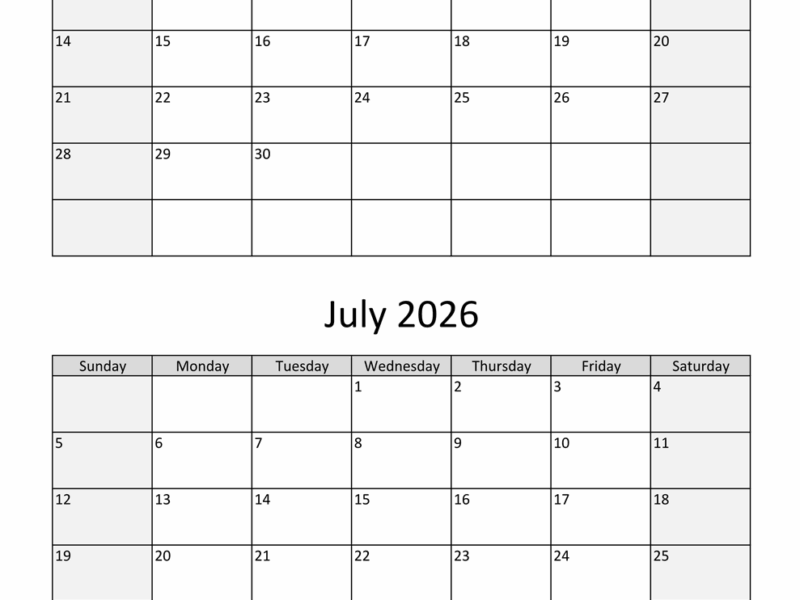

January 2026 Calendar Templates For PDF Excel And Word

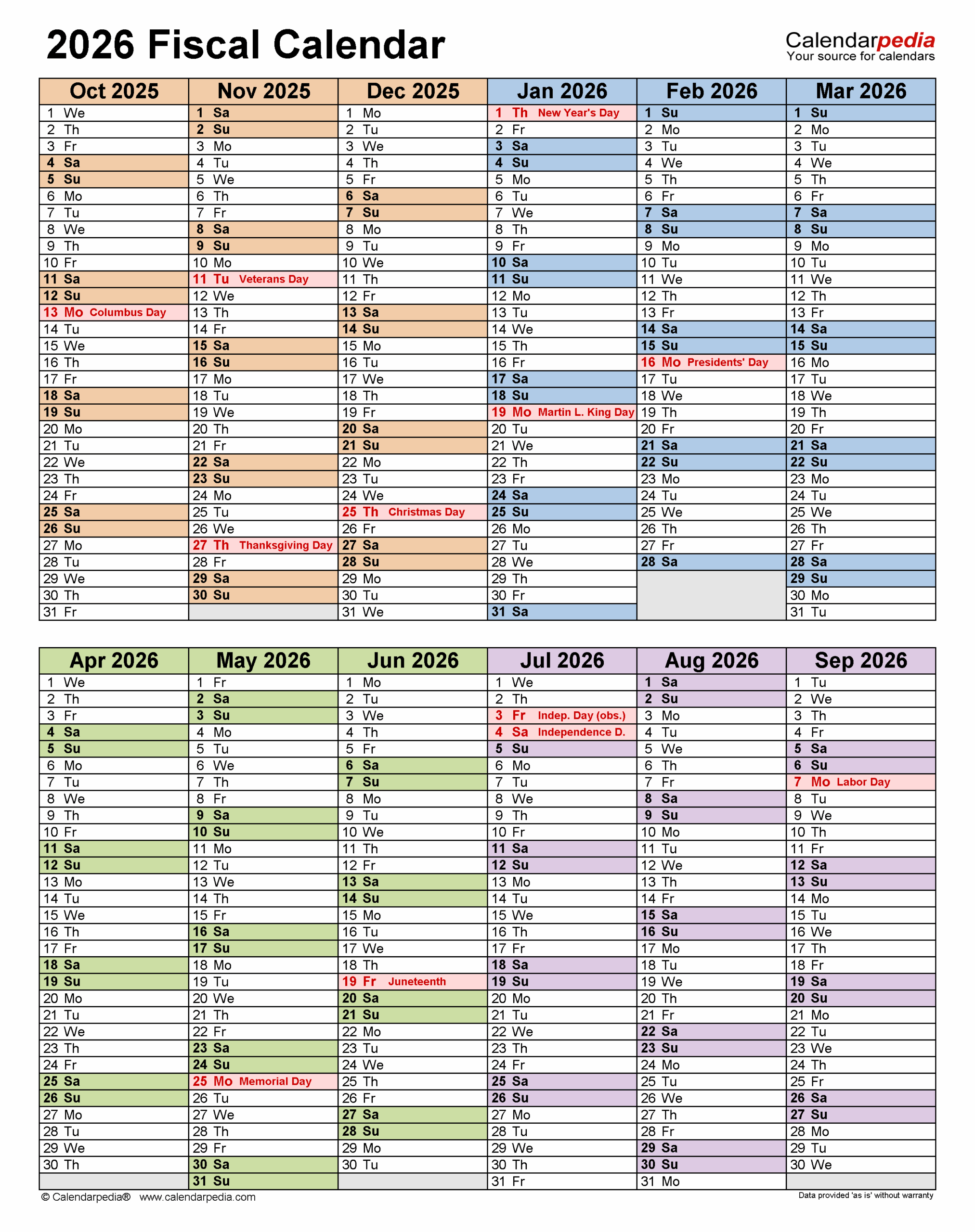

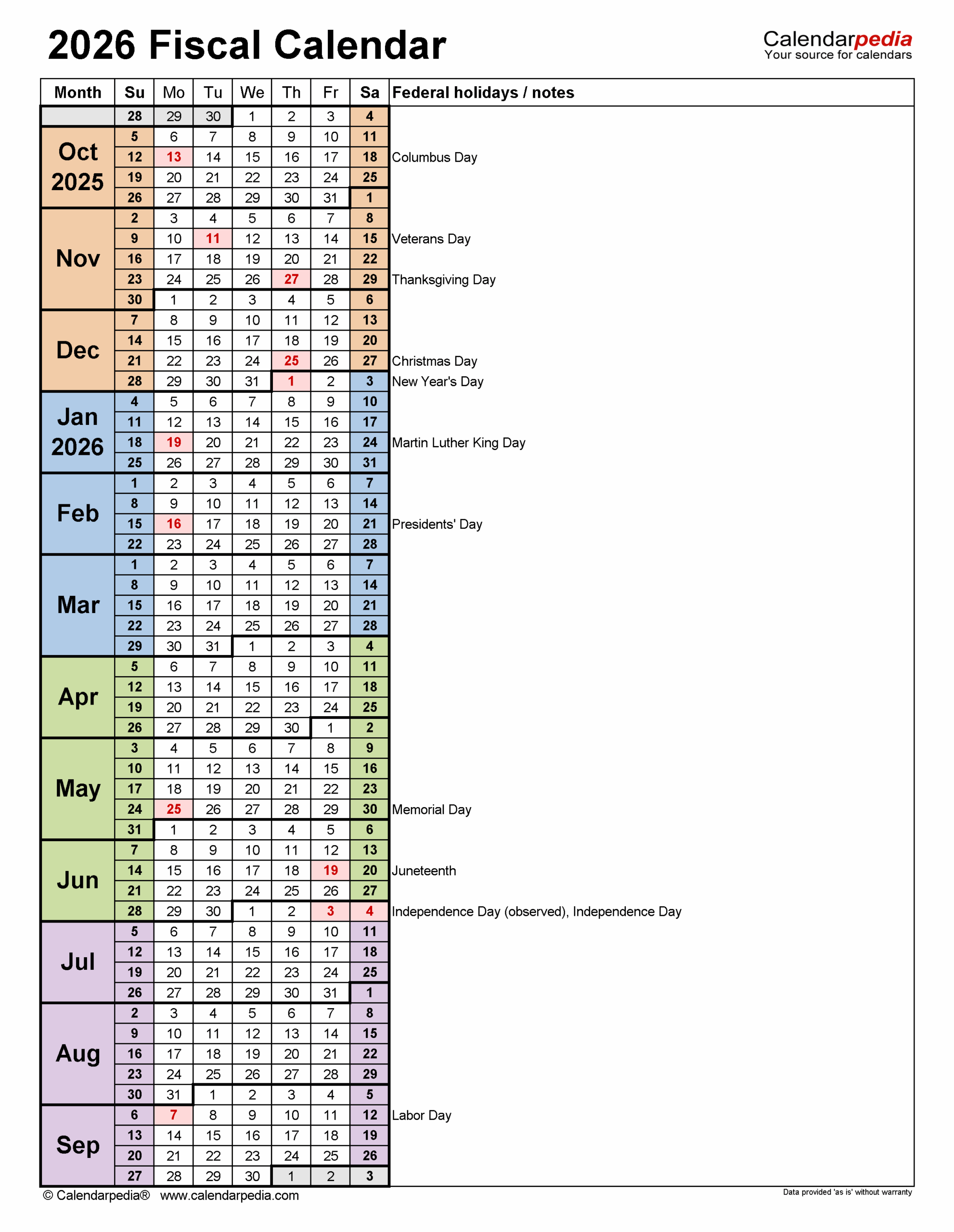

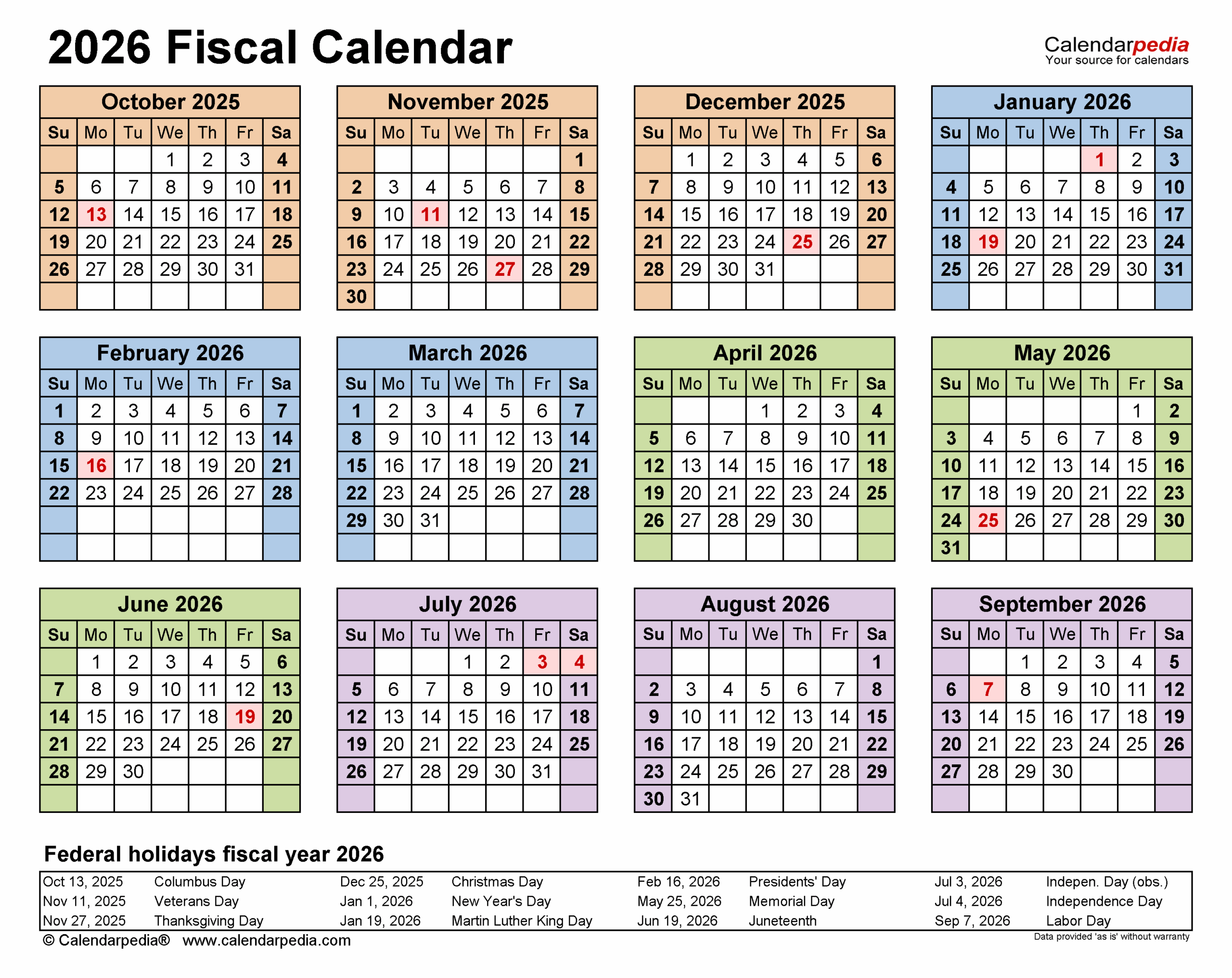

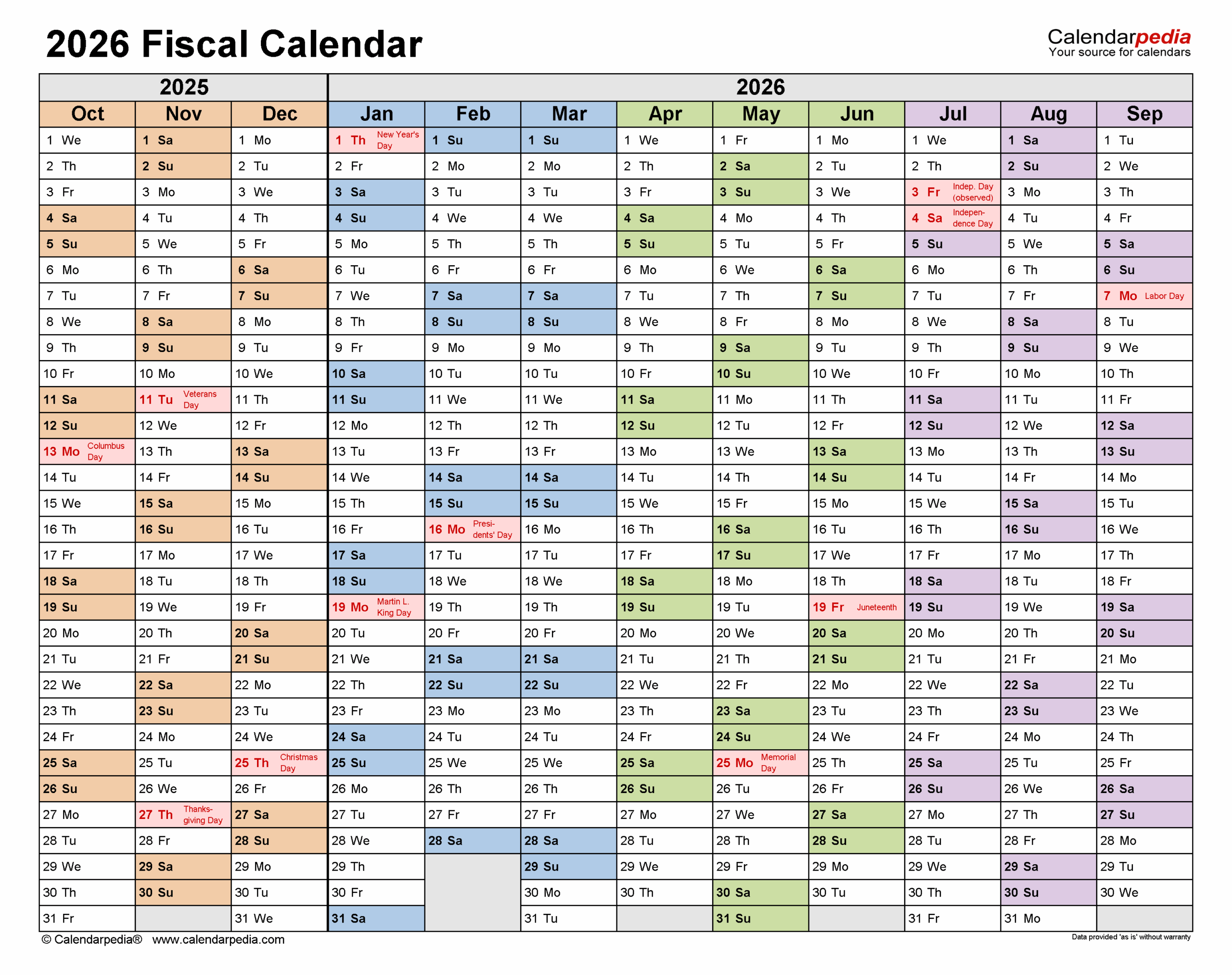

Fiscal Calendars 2026 Free Printable PDF Templates

Fiscal Calendars 2026 Free Printable PDF Templates

Fiscal Calendars 2026 Free Printable PDF Templates

Fiscal Calendars 2026 Free Printable PDF Templates